Decentralized Finance (DeFi) is transforming the financial industry by offering permissionless and transparent financial services built on blockchain technology. Unlike traditional finance, which relies on intermediaries such as banks and brokers, DeFi enables peer-to-peer transactions through smart contracts.

This revolutionary approach allows users to access financial services without centralized control, ensuring efficiency, security, and financial inclusion.

How DeFi Works

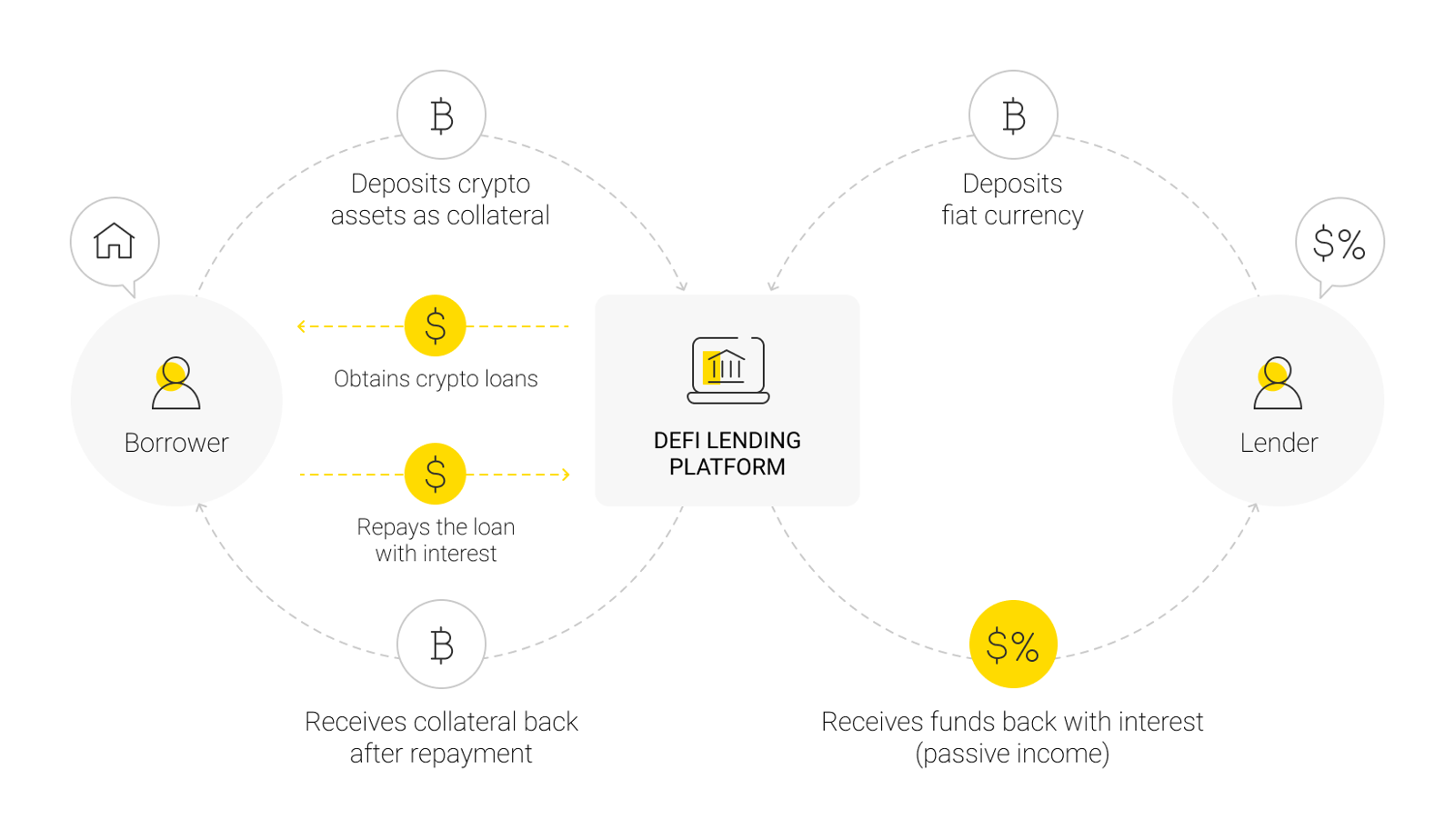

DeFi operates on blockchain networks, primarily Ethereum, leveraging smart contracts to automate transactions. These contracts execute pre-defined conditions without the need for a trusted third party. Users can lend, borrow, trade, and earn interest in their assets without relying on traditional financial institutions.

Key Components of DeFi:

Smart Contracts: Self-executing contracts that facilitate transactions based on predefined conditions.

Decentralized Exchanges (DEXs): Platforms like Uniswap and SushiSwap that allow users to trade cryptocurrencies without intermediaries.

Lending and Borrowing Protocols: Platforms such as Aave and Compound enable users to lend and borrow assets in a decentralized manner.

Stablecoins: Cryptocurrencies like DAI and USDC provide price stability and facilitate transactions.

Yield Farming and Liquidity Mining: Methods for users to earn rewards by providing liquidity to DeFi platforms.

Advantages of DeFi

Read more: NFTs Explained: How Non-Fungible Tokens Are Changing Art

DeFi offers numerous advantages over traditional financial services, making it an attractive alternative for users worldwide.

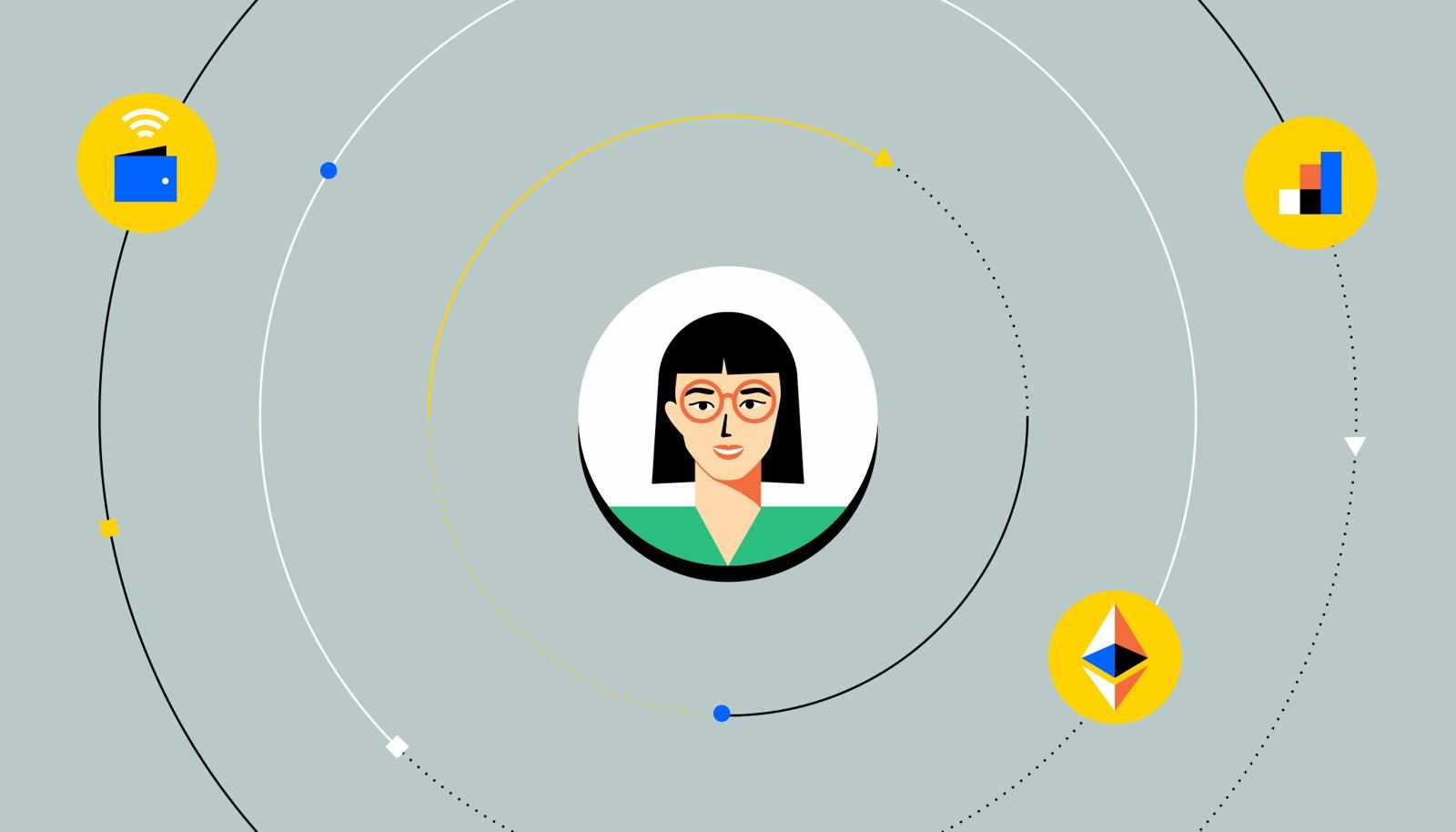

Accessibility and Inclusivity: One of the most significant benefits of DeFi is its accessibility. Anyone with an internet connection and a digital wallet can participate in financial activities, eliminating barriers such as geographical restrictions and banking requirements.

Transparency and Security: DeFi platforms operate on blockchain networks, ensuring transparency and security. Every transaction is recorded on a public ledger, making it auditable and resistant to fraud. Blockchain explorers allow users to track transactions and verify activities in real time.

Cost Efficiency: By removing intermediaries, DeFi significantly reduces transaction fees and operational costs. Users can perform financial activities at a fraction of the cost compared to traditional banking systems.

Challenges Facing DeFi

Despite its potential, DeFi faces several challenges that need to be addressed for mass adoption.

Scalability Issues: Most DeFi applications run on Ethereum, which has faced scalability limitations due to network congestion and high gas fees. Layer 2 solutions and alternative blockchains aim to address these concerns.

Regulatory Uncertainty: Governments and financial regulators are still determining how to regulate DeFi. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations remains a significant concern.

Smart Contract Vulnerabilities: Since DeFi relies heavily on smart contracts, any vulnerability or bug can lead to financial losses. Regular audits and improved security measures are essential to mitigate risks.

The Role of Blockchain Explorers in DeFi

A blockchain explorer is a crucial tool in the DeFi ecosystem. It allows users to track transactions, view wallet balances, and analyze smart contract interactions. Explorers like Etherscan for Ethereum provide detailed insights into DeFi activities, helping users verify transaction details and monitor platform security.

Benefits of Blockchain Explorers in DeFi:

Transparency: Users can view real-time transaction data, ensuring openness.

Security Verification: Helps identify suspicious activities and potential vulnerabilities.

Smart Contract Auditing: Enables users and developers to analyze contract interactions and prevent exploits.

The Future of DeFi

The future of DeFi looks promising, with continuous innovations shaping the financial landscape.

Integration with Traditional Finance: Financial institutions are exploring ways to integrate DeFi solutions into their services. Hybrid models combining decentralized and centralized finance (CeDeFi) could bridge the gap between traditional and blockchain-based financial services.

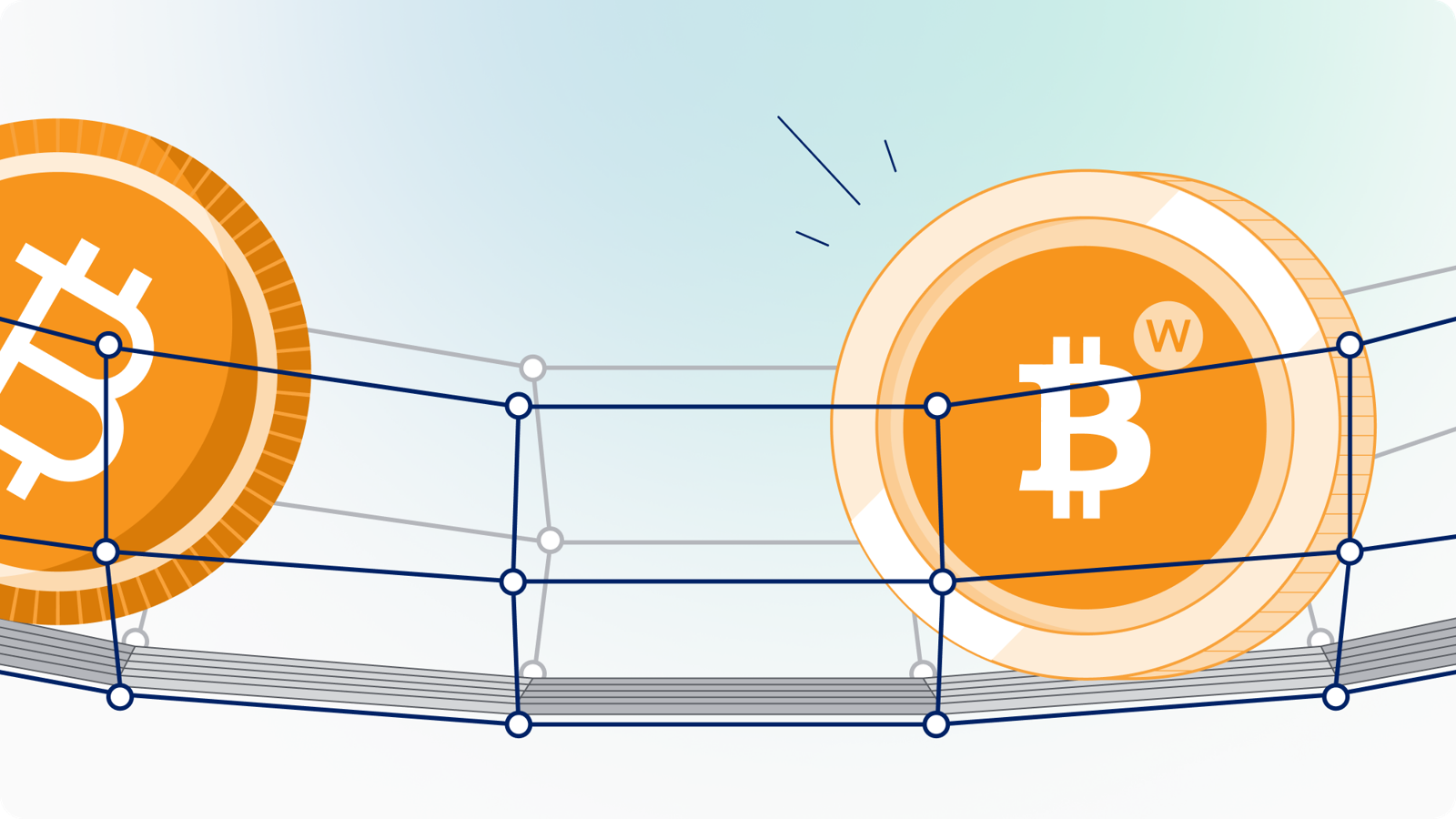

Expansion to Multiple Blockchains: While Ethereum dominates the DeFi space, other blockchains such as Binance Smart Chain, Solana, and Avalanche are gaining traction. Multi-chain interoperability will enhance DeFi's scalability and adoption.

Enhanced Security Measures: Advancements in security protocols, including AI-driven fraud detection and formal verification of smart contracts, will reduce vulnerabilities and increase trust in DeFi applications.

Conclusion

DeFi represents the future of financial services, offering a decentralized, transparent, and accessible alternative to traditional finance. While challenges exist, continuous innovation and regulatory clarity will drive its growth. As blockchain explorers and security measures improve, DeFi is set to revolutionize global finance, empowering individuals with unprecedented financial freedom.

By TopCoin9

Write a comment ...